Creating a successful ecommerce platform is a science. Numerous critical elements must be constructed to support a positive experience and, in turn, encourage the user’s decision to purchase. These elements can be strategically woven to create a profitable customer journey.

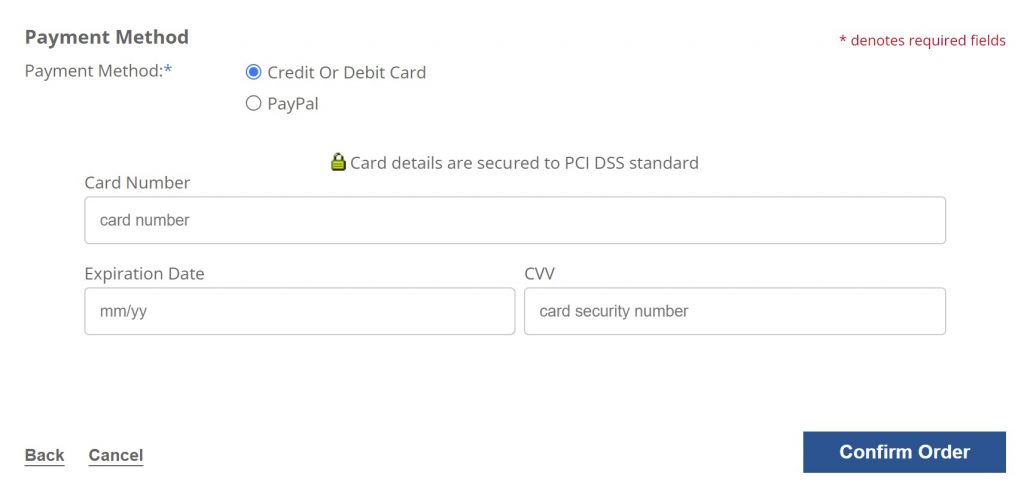

Building an optimized checkout page is undoubtedly one of the most important considerations for online retailers. Giving customers a safe and easy-to-navigate user interface as well as popular payment choices can significantly change their purchasing habits.

When it comes to payment providers, there are a lot of benefits to using PayPal and the variety of payment methods supported by their technology. This blog post will explore the payment methods available and why you should consider using their service on your ecommerce site.

The Benefits of Using PayPal – A Quick Summary:

- Affordable

- Safe and secure

- Supports various payment options

- Trusted by retailers and customers

- Easy to integrate into your website

- Resources and support available via the PayPal Portals

- Advanced software (iframe payment fields)

PayPal has become one of the world’s largest payment networks, present in over 203 global markets. They’ve proven themselves to be a technically competent, trusted provider with high uptime and low payment issues. Their platform supports a range of payment methods, including standard PayPal, credit cards, debit cards, PayPal Pay Later, and specific local payment methods. These options have been securely developed for optimum user experience and integrated into a compelling package to provide a seamless checkout.

As a shopper, it’s common to see the familiar PayPal logo when browsing online. This alternative is standard amongst retailers and highly effective as a report by Nielsen showed customers are three times more likely to purchase when PayPal is an option at the checkout¹. Ensuring that you meet customers’ preferences is critical, as the same research highlights that 71% of customers are likely to trust businesses that offer their preferred payment method. Bolstering the need for ecommerce businesses to provide a variety of payment options to increase the likelihood of conversions.

For ecommerce websites, PayPal offers an unbranded payment provider package. The advanced software can create an unbranded checkout page on your website. It can be easily integrated thanks to the fast setup features and comes with all the benefits of PayPal, such as being fully compliant with regulations and using 3D secure V2. In addition, there’s a variety of support available including the customer support phone line, the Customer Portal and the PayPal Developer Portal. Helpful tools, resources, and documentation can all be found online.

In addition, PayPal’s unbranded payment software uses advanced iFrame payment fields to collect data. If approved by the user, this securely captures payment information and retains it for later use, providing returning customers a clean, frictionless payment experience.

Various transactions such as Pay with PayPal, Paypal Pay Later, Debit and Credit Cards, and APM transactions are all settled to one PayPal account. This makes it incredibly easy for users to quickly see all their transactions, settlements, and relevant reports, simplifying the account management process for individuals and businesses.

Retailers can rest easy knowing that this solution is competitively priced within the market. Paypal’s headline card processing rate for payments in the UK is 1.2% plus £0.30. This is cheaper than alternative providers within the market and has excellent value for money considering all of the additional benefits.

Thoughts of our CEO, Josh Barling – “PayPal has always been a key partner for our customers and us. With all the payment methods and features your customers demand available through a single provider, PayPal is a preferred choice for our customers.”

Click here to find out more about PayPal for businesses.

¹ Nielson. (2022). How PayPal Helps Drive Revenue Growth and Boost Conversion, Spend & Satisfaction.